Here’s the key problem: owning a deeded timeshare isn’t just a vacation plan — it’s real estate.

Just when you thought you had your maintenance fees figured out…

You open the mailbox and see another notice from your resort. It isn’t your regular annual maintenance bill this time — it’s a special assessment fee.

Your first thought? What is this, and why do I have to pay it on top of everything else?

Unfortunately, this isn’t an error. It’s another built-in risk of deeded timeshare ownership. And for many owners, it’s the fee that finally pushes them over the edge.

In this article, we’ll explain what timeshare special assessments are, why resorts charge them, and what you can do to stop getting blindsided.

What Is a Timeshare Special Assessment?

A special assessment is an additional charge that timeshare owners can be required to pay, on top of their annual maintenance fees. Resorts typically use them to cover unexpected expenses like:

- Major property repairs (roofs, elevators, plumbing)

- Storm damage or natural disaster recovery

- Lawsuits or legal settlements against the resort

- Renovations or upgrades that the HOA deems “necessary”

Unlike maintenance fees, which are (somewhat) predictable, special assessments can arrive without warning and cost hundreds — even thousands — of dollars.

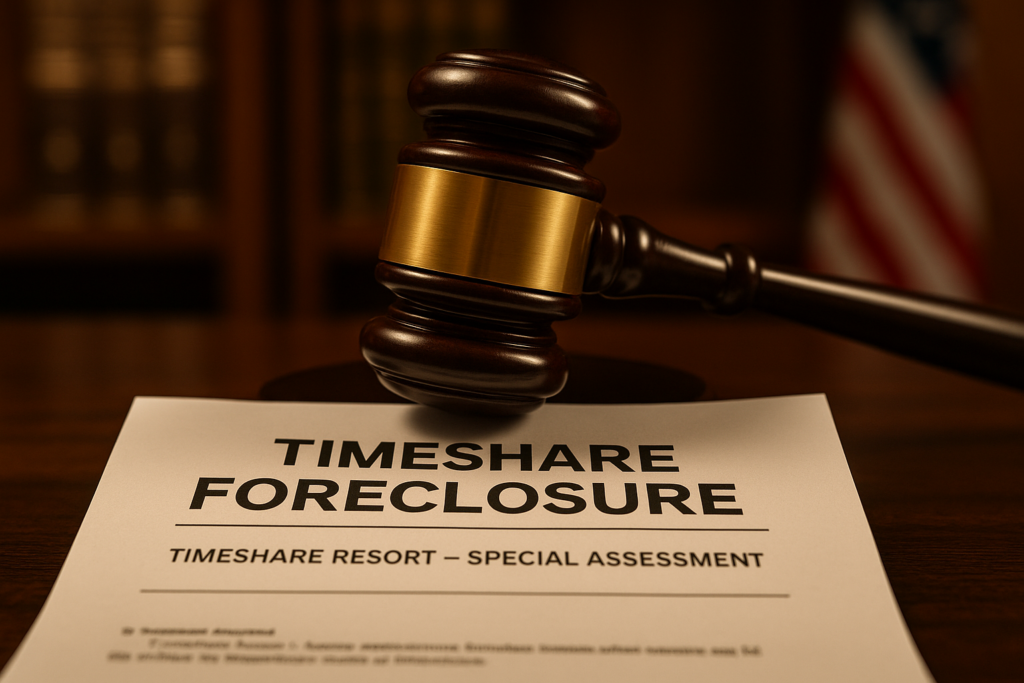

Why Timeshare Deeds Mean Never-Ending Responsibility

Here’s the key problem: owning a deeded timeshare isn’t just a vacation plan — it’s real estate.

That means:

- You own a slice of property, however tiny.

- As a deeded property owner, you are legally tied to your share of the resort’s expenses.

- Resorts (and their HOAs) have the right to assess you when “extraordinary” costs come up.

The irony? Your one week of vacation may be worth less than $1 on the resale market — but your obligations as a property owner can last a lifetime.

It’s just big enough to keep you on the hook, but too small to be worth anything if you try to sell it.

The Unpredictability Problem

With maintenance fees, at least you know they’re coming every year (even if they go up).

Special assessments are different. They’re unpredictable — you never know when or how much you’ll be charged.

Here are a few real-world examples of why owners suddenly get hit with these bills:

- A hurricane damages roofs and common areas → every owner gets assessed $4,400.

- A lawsuit settlement drains the resort’s funds → owners are assessed $800 each.

- An HOA votes to add a new pool or fitness center → owners pay $1,300 each.

The risk is constant. Even if you manage to budget for your annual fees, there’s always the possibility of another surprise bill in the mail.

What If You Can’t Pay a Special Assessment?

Here’s where things get stressful. If you don’t pay:

- Late fees and interest start piling up.

- Your account can be sent to collections.

- The resort may even pursue legal action against you, including a foreclosure, should things go on long enough.

- Your credit score can take a hit and foreclosure can sit on your credit report for years.

Because the obligation is tied to your deed, walking away isn’t as simple as ignoring the bill. The resort has the legal right to pursue payment.

Why Special Assessments Feel Unfair

Most owners agree: these fees feel like moving goalposts.

You signed up thinking you’d pay annual maintenance fees — but then the resort can demand more whenever it decides the property needs upgrades, repairs, or debt coverage.

And you don’t really have a choice. Even if you never use your timeshare, even if you disagree with the decision, your signature on that deed means you’re still responsible.

How to Avoid Timeshare Special Assessments

Unfortunately, there’s no way to fully avoid special assessments while you still own your timeshare deed.

Some owners try to:

- Budget extra savings each year in case another fee shows up.

- Fight HOA decisions — but most votes are controlled by resort management.

- Rent out their week to cover the costs — but demand is low, and it rarely covers surprise fees.

These “band-aid” solutions don’t solve the underlying problem: as long as you hold the deed, the responsibility is yours.

Legal Options for Ending Special Assessment Risk

The only guaranteed way to stop special assessments is to legally exit your timeshare.

That’s where a trusted timeshare exit company like Timeshare Recyclers can help. By working with experienced attorneys, you can:

- Terminate your deed and end all ongoing obligations.

- Protect yourself from future fees, assessments, and liabilities.

- Finally move on without worrying about the next unexpected bill.

For many owners, a special assessment is the wake-up call that it’s time to get out.

Key Takeaway

Owning a deeded timeshare means you’re not just a vacationer — you’re a property owner. And that means you’re on the hook for every expense, from maintenance fees to unpredictable special assessments.

You can’t stop the fees from coming — but you can stop owning the deed that makes you responsible.

Don’t Let Another Surprise Bill Catch You Off Guard

If you’re tired of the stress of unexpected fees, now is the time to explore your options.

👉 Schedule a free consultation with Timeshare Recyclers and learn how to permanently end your timeshare obligations.